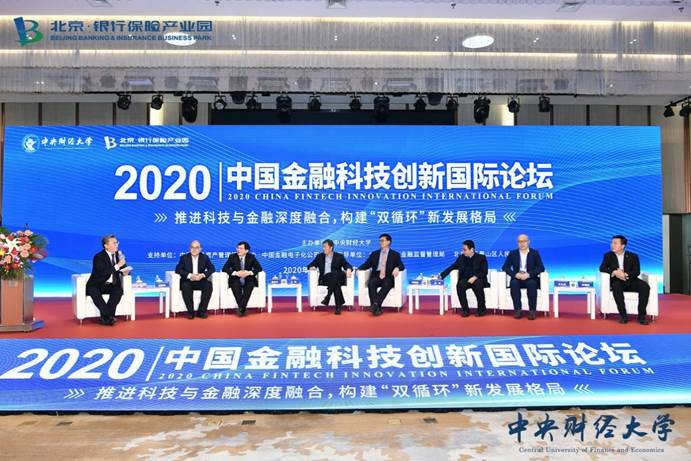

Advised by the Beijing Local Financial Supervision and Administration and the Shijingshan District People's Government of Beijing Municipality, hosted by Central University of Finance and Economics (CUFE), organized by the School of Finance, CUFE, the 2020 China Fintech Innovation International Forum took place at the Cultural Exchange Center of Beijing Banking & Insurance Business Park on December 24, 2020, under the theme of "Integrating Technology with Finance, Creating a 'Dual Circulation' New Development Pattern.” Among more than 200 attendees were leaders from the Beijing Local Financial Supervision and Administration, the Shijingshan District People's Government of Beijing Municipality and CUFE, representatives from financial institutions and business groups, prestigious financial experts and scholars, as well as teachers and students from CUFE. Several financial and economic media platforms streamed the forum, attracting over 400,000 viewers.

The forum focused on issues such as the development of new financial business, technology-empowered traditional finance, financial services for the real economy, the prevention of new financial risks, and the construction of financial-industrial parks, offering valuable policy-related references and suggestions for promoting the economic development of China, especially creating a "dual circulation" new development pattern under the new situation. While further facilitating exchanges and cooperation between local governments and universities, between research institutes and industrially leading enterprises, the forum promoted the integrated development of governments, enterprises, universities, and research institutes in the fintech field.

Yan Sun, a financial reporter at CCTV Press Center and a National Financial Youth Federation member, hosted leaders' addresses and the signing ceremony. CUFE and Shijingshan District leaders delivered opening talks, extending a warm welcome and heartfelt thanks to the guests present.

Xiuchao He, Party Secretary of CUFE, said CUFE had attached great importance to improving its ability to serve national economic and social development. The School of Finance, CUFE, became one of the first Chinese colleges and schools to conduct theoretical research on fintech in 2014 and took the lead in establishing the fintech department and offering a fintech program among Chinese universities. It has developed a fintech talent training system at three levels: bachelor, master, and doctor, and focused on building a fintech education highland and a high-level think tank platform. The school's "financial security engineering" has been selected as a sophisticated discipline among universities in Beijing. The Engineering Research Center of the Ministry of Education for National Financial Security has been established. To form a longstanding enterprise-university-institute partnership and fully leverage CUFE's strengths in fintech research and fintech talent training, as well as Shijingshan's strengths in financial industry support and financial management service, CUFE and the Shijingshan District People's Government of Beijing Municipality will carry out various forms of fintech exchanges and cooperation at all levels, and accelerate the cooperative research and development of Shijingshan and Beijing Banking & Insurance Business Park in the fintech field. CUFE will work with relevant sides to constantly deepen and broaden cooperation in fintech innovation and promote the steady development of fintech innovation and the financial industry.

Xiuchao He, Party Secretary of CUFE, delivers an address

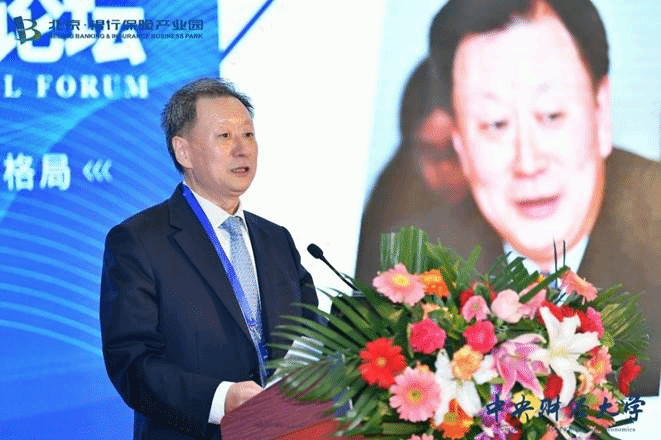

Addressing the forum, Xin Li, Deputy Secretary of the CPC Shijingshan District Committee and Head of Shijingshan District, introduced Shijingshan's achievements and plan. As a critical industrial functional zone jointly developed by the China Banking and Insurance Regulatory Commission and the People's Government of Beijing Municipality, Beijing Banking & Insurance Business Park aims to build a national financial industry demonstration zone amid the broader opening of the service sector, he said. As the central front for fintech development in Shijingshan, Beijing Banking & Insurance Business Park will work with CUFE to develop a featured fintech park and an outstanding financial demonstration project. Shijingshan will create a favorable business environment for fintech enterprises and build an open, innovative, inclusive, and shared fintech ecosystem.

Xin Li, Deputy Secretary of the CPC Shijingshan District Committee and Head of Shijingshan District, delivers an address

Following the addresses, witnessed by all the guests, the Shijingshan District People's Government of Beijing Municipality signed strategic cooperation framework agreements with CUFE and China Financial Computerization Corp. (CFCC). With this as an opportunity, Shijingshan will advance exchanges and cooperation with universities, research institutes, and industrially leading enterprises, promote fintech industry incubation, talent training, academic research, and achievement transformation, empower finance by technology, and support business entities by finance, to develop into a new highland for the change, upgrading, opening-up, and development of the service sector.

Chunli Qi, Member of the Standing Committee of the CPC Shijingshan District Committee and Executive Deputy Head of Shijingshan District, signs a cooperative agreement with Jianping Shi, Vice President of CUFE

Chunli Qi, Member of the Standing Committee of the CPC Shijingshan District Committee and Executive Deputy Head of Shijingshan District, signs a cooperative agreement with Yongfu Zhang, President of CFCC

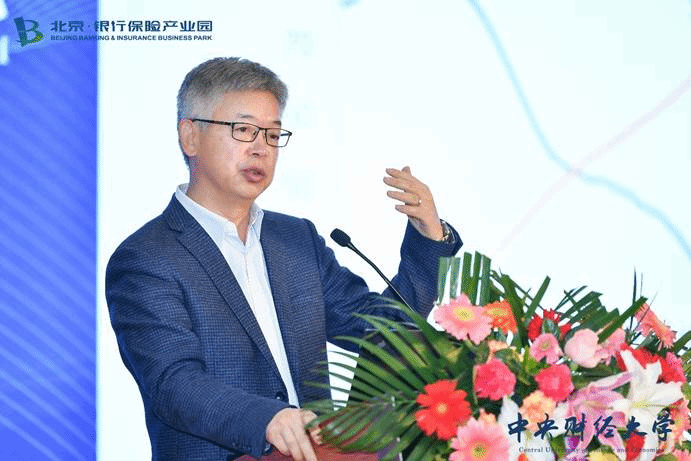

Then Prof. Jianping Shi, Vice President of CUFE, hosted keynote speeches. Yang Li, an academic member of the Chinese Academy of Social Sciences (CASS) and Chairman of the National Institution for Finance & Development (NIFD); Yingning Wei, former Vice Chairman of the China Insurance Regulatory Commission (CIRC); Lihui Li, a member of the Financial and Economic Affairs Committee of the 12th National People's Congress and former President of Bank of China (BOC); Prof. Yiping Huang, Deputy Dean of the National School of Development (NSD) and Director of the Institute of Digital Finance (IDF) at Peking University (PKU); and Prof. Shusong Ba, Chief Economist of the China Banking Association (CBA) delivered keynote speeches.

Jianping Shi, Vice President of CUFE, delivers a keynote speech

Yang Li, an academic member of CASS and Chairman of NIFD, delivered a keynote speech entitled "Problems of Fintech under 'Dual Circulation.’” He noted that China would face five risks from home and abroad in 2021: the sluggishness of the global economy caused by the inefficient control of COVID-19, bubbles of debt and capital markets, side effects of "conventional" monetary and fiscal policies, and the continuous worsening of Sino-U.S. frictions in fields such as intellectual property, subsidies for state-owned enterprises, human rights, market opening-up, and environmental protection. Regarding these problems, he said China has come up with a solution: "dual circulation" under the leadership of the Party Central Committee with Xi Jinping as its core. Then he elaborated on the four points of "dual circulation" and the eight critical tasks for 2021. At last, he introduced the process of financial renovation empowered by technology, considering the primary function of fintech as destructing and restructuring new industries by digitalization.

Yang Li, an academic member of CASS and Chairman of NIFD, delivers a keynote speech

Yingning Wei, former Vice Chairman of CIRC, delivers a keynote speech entitled "Insurance Technology: Innovation and Inclusiveness.” COVID-19 has raised public awareness of risks and stimulated public demand for insurance, especially health insurance. Thus the insurance industry has been less affected by COVID-19, he said. Premier Li Keqiang chaired an executive meeting of the State Council on December 9, 2020, deploying measures for improving the scale and quality of personal insurance and facilitating its steady development to meet the people's diverse needs. He thought improving the ranking and quality of private insurance relies on government support first, market mechanisms in the second place, and technologies, finally introducing the new progress of insurance technology based on changes in insurance sales channels. At last, he introduced the relations between insurance technology and inclusiveness with the development of "Medicare" as an example, noting that insurance technology can make insurance inclusive. Referring to the future of insurance technology, he thought the insurance sector should use big data, AI and IoT intensively, integrate online operations with offline operations, increase the proportion of online sales, and improve the capabilities of risk identification and monitoring.

Yingning Wei, former Vice Chairman of CIRC, delivers a keynote speech

Lihui Li, a member of the Financial and Economic Affairs Committee of the 12th National People's Congress and former President of BOC, delivered a keynote speech entitled "Digitalization under a 'Dual Circulation' Pattern.” Circulation is the life of the market economy, and circulation efficiency determines the efficiency of resources allocation, the cost of economic operation, the output of production factors, the structure of the people's income, payment ability, and consumption quality. The principal part of the dual circulation is the domestic cycle, the efficiency of the domestic process is the key, and digitalization plays an irreplaceable driving role in dual circulation. He interpreted data elements, digital trust, digital currencies, and digital technology competition, emphasizing efforts to maintain data privacy and security, open and share public data, and realize the integrated application of data elements. He noted that we should empower business credit by the digital trust to address the problems of "identity, ownership, command, and control,” calling for efforts to lose no time in developing feasible paths and implementation plans for global digital currencies dominated by China. As equality in digital technology is the basis of fair competition in the digital economy, we must speed up efforts to realize self-reliance in core hardware and software.

Lihui Li, a member of the Financial and Economic Affairs Committee of the 12th National People's Congress and former President of BOC, delivers a keynote speech

Prof. Yiping Huang, Deputy Dean of NSD and Director of IDF at PKU, delivered a keynote speech entitled "Digital finance innovation empowers the new economic pattern.” He first noted that China would face three significant challenges: the loss of low-cost advantage, population aging, and deglobalization, considering "dual circulation" as an important way to address these challenges. China should strengthen supply and demand circulation while boosting domestic demand, increasing technology content through innovation to promote industrial upgrading, thus switching from factor input growth to innovation-driven growth. Then he introduced how fintech solves the difficulties of financial institutions in customs acquisition and risk control in terms of extending loans to micro, small and medium enterprises, citing solutions such as sci-tech credit and digital supply chain finance. As China now leads the world in digital finance, financial institutions and regulators need to work together to keep the digital finance industry going, thus securing China's lead in digital finance, he said.

Prof. Yiping Huang, Deputy Dean of NSD and Director of IDF at PKU, delivers a keynote speech

Prof. Shusong Ba, Chief Economist of CBA, delivered a video speech entitled "Trend of the Transformation of China's Banking Industry in the Digital Economy Era.” The digital economy has become a world focus in the era of globalization differentiation. He said that the proportion of the digital economy in GDP is rising accelerated. The Internet and intelligence have promoted the transformation of financial institutions, and banks have been exploring the digital transformation of e-commerce platforms, direct banks, and open banks as active players in digital transformation. However, the digitalization of Chinese banks is restricted by limited channels and the shortage of scenarios. In this context, we can achieve breakthroughs in bank digitalization by connecting scenarios, building new connections for open platforms, data assets, and federated learning technologies, and promoting the digitalization of regulation.

Prof. Shusong Ba, Chief Economist of CBA, delivers a video speech

Prof. Guangqian Wang, Director of the Steering Committee for Finance Teaching in Institutions of Higher Learning under the Ministry of Education (MOE) and former President of CUFE, hosted the last morning session: "Nobel Laureate's View of Fintech.” 2014 Nobel Laureate in Economics Prof. Jean Marcel Tirole delivered a video speech entitled "Economics of Fintech and Central Bank Digital Currencies.” He said fintech, an integrator of technology and financial services, is a great revolution, a fantastic new thing, and a process of creative destruction, which will bring new opportunities and challenges. Digital currencies are an integral part of fintech progress; the world is in a currency war: the development of private digital currencies poses a challenge to national public policies, and central bank digital currencies are gradually developing into a more secure, convenient, and low-cost new payment mode. A flexible and innovative payment system under which many currencies coexist takes shape. He reminded us that we must follow and apply the fundamentals of fintech and stick to the rationale for traditional finance; we must not ignore the basic logic and fundamentals behind the impact of new technologies: those who ignore history are doomed to repeat it, and those who ignore warnings of financial risk theories are bound to trigger risks.

Prof. Guangqian Wang, Director of the Steering Committee for Finance Teaching in Institutions of Higher Learning under MOE and former President of CUFE, hosts "Nobel Laureate's View of Fintech."

2014 Nobel Laureate in Economics Prof. Jean Marcel Tirole delivers a video speech

At the first afternoon session, Zaozhong Xing, President of Financial News, hosted a keynote speech entitled "Financial digitalization drives a 'dual circulation' new development pattern.” Several guests spoke under this theme.

Zaozhong Xing, President of Financial News, hosts a keynote speech session

Kang Jia, President of China Academy of New Supply-side Economics (CANSE), delivered a keynote speech entitled "Financial Digitalization Innovation and Dual Circulation.” Referring to the fintech-empowered real economy and "dual circulation,” he said we should see realistic and strong demand for the integrated innovation of finance and technology to guide the new normal in economic development and achieve national rejuvenation. He fundamentally analyzed tech finance and fintech in this context and introduced the integrated development of finance and technology. Then he shared his view on integrity and innovation in fintech development, offering the essentials of integrity and innovation from the perspectives of commercial finance and financial regulation. At last, he stressed that overall development and innovative development are top priorities. So is integrating finance and technology to serve industrial upgrading and development and pursuing the modernization of China.

Kang Jia, President of CANSE, delivers a keynote speech

Zhujun He, Vice President of the Insurance Asset Management Association of China (IAMAC), delivered a keynote speech entitled "The insurance asset management industry should adhere to the intrinsic unity of innovation drive and prudential operation.” Circulation is essential to the "dual circulation" new development pattern, and the core is facilitating the free, fair and efficient flow of all factors, he said. He noted that China is expected to develop faster into the world's largest insurance market under a "dual circulation" new development pattern. Insurance capital has increased investment in major consumption and technology, and the high-tech sector has become a new investment focus of insurance capital. The involvement of insurance capital and insurance assets in the creation of a "dual circulation" new development pattern is inseparable from the foundation of the world's second-largest insurance market, the features and specialties developed in the primary asset management market, as well as the digital integration of the insurance asset management industry empowered by asset management technology. He noted that we should improve the capability of cyclic asset allocation, manage long-term funds and provide long-term capital, tap capital efficiency, drive the insurance asset management industry to create a "dual circulation" new development pattern, and promote the long-term and high-quality development of the economy.

Zhujun He, Vice President of IAMAC, delivers a keynote speech

Gang Zeng, Deputy Director of NIFD, delivered a keynote speech entitled "Financial Support for 'Dual Circulation.’” To create a "dual circulation" new development pattern, we should optimize the structure and efficiency of financial supply based on the needs of the real economy, he said. The key to the domestic cycle is expanding domestic demand that includes consumption and investment in a new way. On the part of consumption, we need to prioritize employment, continue to develop inclusive finance, and provide more effective financial support for market players such as micro, small and medium enterprises. On the side of investment, focusing on consumption upgrading and high-quality economic development, we need to develop new investment growth points and intensify financial support for industrial upgrading, sci-tech innovation, green development, and other fields. Fintech can improve financial services for "dual circulation," whether in consumption or investment and create broad space for its development.

Gang Zeng, Deputy Director of NIFD, delivers a keynote speech

Fan Yang, Chairman of Trust Mutual Life, delivered a keynote speech entitled "Insurance opens up a new digitalization era.” He said the release of the Measures for the Regulation of Internet Insurance Business marks the opening of a new era for Internet insurance. Enterprises will evolve from Internet-based enterprises into digital and intelligent enterprises in the digital age. To better cope with digitalization, enterprises will face the changes in "DNA,” "organizational structures,” "technical architectures,” "operation modes,” "interactive paths," and "product forms.” Complete digitalization is a challenge for the transformational development of all insurance agencies and a hard-won historical opportunity for them.

Fan Yang, Chairman of Trust Mutual Life, delivers a keynote speech

Lei Cai, Vice President of JD Group, delivered a keynote speech entitled "Internet Development and Smart Finance & Tax.” He interpreted the new economy and new business innovations from the theory of Internet development, industrial practice, and prospect. He shared JD's goal of serving 1.5 billion consumers and nearly 10 million enterprises worldwide through its tech-empowered digital social supply chain. As long as enterprises keep pace with the times and make persistent innovations, they will eventually help improve the efficiency of social and economic operations, create new economic value, and make more significant contributions.

Lei Cai, Vice President of JD Group, delivers a keynote speech

At the last session of this forum hosted by Gang Wan, Executive Dean of Zhongchai Rongma School of Management, senior experts from industries such as banking, insurance, and securities had a dialogue themed "Development of Banking, Trust, Securities and Insurance Empowered by Sci-tech Innovation.”

Gang Wan, Executive Dean of Zhongchai Rongma School of Management, hosts a dialogue